Background

In the information Technology (IT) based era, mobile phone users are realizing the value of mobile device and its utilization along with application in their daily business and non – business activities and movements. They have shifted their perception of the mobile handset (phone) from that of a voice telephone device to that of a personal e–commerce and trade device. It is because of changes happening in the mobile network technologies further which ensure the strength of mobile phone application to the users.

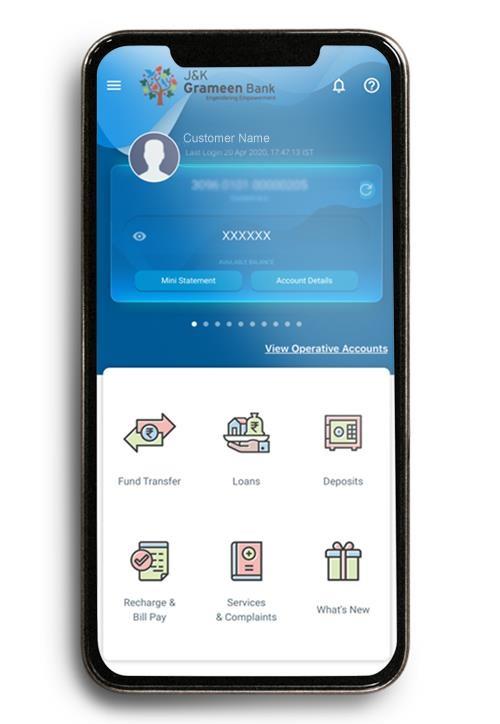

It has been the endeavour of Bank to leverage technology for providing convenient digital services to our customers. In continuation with this objective, the Bank has launched Mobile Banking Application and same is available to customers on Google Playstore under name and title of JKGB m-Bank.

Mbank can be accessed on both Android and iOS platforms. The Apps is compatible with Android 4.2.2 and above/iOS 8.1 and above versions.

How JKGB m-BANK is unique?

- Secure & easy to use.

- Immediate money transfer through mobile device round the clock 24*7 and 365 days using NEFT/IMPS Channels for interbank.

- Intrabank /self-account fund transfer.

- Single mobile application for accessing different bank accounts.

- Best answer to Cash on Delivery hassle, running to an ATM or rendering exact amount.

- Complaint management.

- Supports menu-based applications that is easy to manoeuvre for the users

- Round the clock availability (works even on holidays)

- Term Deposit Account Opening available

- Features like Balance enquiry, Account details, Nomination Updations available.

- Features like Generate/Reset ATM Pin, Hot listing of ATM Card and request for new debit card available.

- Features like cheque book request, Enquire Cheque status and stop issued cheque available

- Many other Features like BBPS (Bill payment), setting of card limits on different channels will be available soon.

Pre-requisites for customers to register

- The customer should have the same Mobile No. registered with the bank through which he/she wants to register for m-Bank.

- The Mobile Number of the customer should not be registered with multiple Customer IDs.

- The customer should be KYC compliant.

- The customer account should have a valid and active Debit Card linked to it.

- The facility is available to pre-paid as well as post-paid mobile subscribers.

Steps for Registration:

- User downloads the JKGB m-BANK application from the Google PlayStore or Applestore

- User agrees to Registration terms and conditions and choose sim linked (in case of dual sim) in account for sending SMS.

- In case of error ‘Multiple cust-id exists on mobile number’, customer has to rectify the same from concerned branch.

- Registration page has two options

- Registration through Debit Card: Customer can use debit/ATM card details viz. Card number & ATM PIN. Customer has to ensure card is active and at least a single financial transaction has been completed through card

- Registration Branch Token : For customers not in possession of Debit/ATM card, registration can be done through tokens generated at Initiating Branches(Branches where customer Id was generated)

Set Login PIN & transaction PIN:

- User will be directed to set Login Pin(MPIN) & Transaction PIN (MTPIN)

Manage Payee

- User has to register Beneficiary account before the Fund Transfer.

- Manage Payee is available in Fund Transfer or Services & Complaint Section.

- Customer can transfer funds to the Beneficiary account after 30 min of addition.

Performing m-BANK financial Transaction:

- User can use Fund transfer option.

- Customer can choose intrabank/interbank transactions.

- For Intra-Bank transaction, two channels viz. IMPS and NEFT are available

- In case of failed NEFT Transaction with message ‘Invalid IFSC’ customer can contact Branch for addition of IFSC.

Non-financial & other transactions/operations

- m-BANK supports following types of non-financial transactions.

- Mini statement: Gives Detail of last 10 transactions

- Account Details: Gives the detail of account

- Cheque Book Services

- Book Request: Customer can request for issuance of personalized or non-personalized Cheque book

- Status Enquiry: Gives the status of a Cheque

- Stop Cheque: Customer can stop the processing of a cheque

- ATM/Debit card Services

- Generate /reset Debit Card Pin

- Hotlist /Block Debit card

- Request for ATM/Debit card

- Nominee Updation in an account

- Complaint management

New features in the Application :

1) Insta Pay option: J&K Grameen Bank customer can instantly pay upto Rs 50,000 interbank & upto Rs 5,00,000 intrabank without the hassle of adding Beneficiary. Per day overall transaction limit of Rs 5,00,000 and Monthly Limit of Rs.40,00,000 remains unchanged. Auto Beneficiary addition also available with the instant fund transfer

2) Notification: Application will provide customers details of last 10 activities on Mobile Banking Application

3) Transaction History: Application will provide customer details of last 10 Financial transactions done through Mobile Banking Application

4) Account Statement: Application will allow customer to download account statement for up to 365 days.

5) Manage Payee: Additional option on Dashboard to facilitate Payee addition, modification & deletion

6) Accounts: Additional option on Dashboard to view all operative accounts

7) View Interest Rate: While opening new account, customer has the option to View Interest Rate.

8) FD Receipt: While opening deposit account through application customer can download the FD receipt or share it.

9) Advance Application capability : Mobile application capability has been enhanced to handle 92 accounts for a single customer( 16 operative, 16 loan & 60 deposit account)

10) Beneficiary addition: To provide hassle free beneficiary addition , service will use only MTPIN for verification , additional OTP validation has been disabled

11) Whats new: Additional option inside the application to provide updates on Banks recent activity

12) Positive Pay system through JKGB mBank

Maximum limit on transactions

The daily upper limit for fund transfer per Customer is Rs.5,00,000/- for aggregate of fund transfers irrespective of channel. The monthly limit is Rs.40,00,000. Maximum number of transactions shall be 10 per day.

Charges

NEFT/IMPS Remitter Transactions Charges.

Transaction Amount NEFT Charges IMPS Charges

Upto Rs 10,000/- Rs 2 +GST Rs 5 +GST

Above Rs 10,000/- upto 1,00,000/- Rs 4 +GST Rs 5 +GST

Above Rs 1,00,000/- upto 2,00,000/- Rs 12 +GST Rs 15 +GST

However, fund transfer from SB accounts through NEFT is exempted.

Charges for Generation & Reset of ATM PIN through Mobile banking application shall be Rs 5+GST.

Charges for cheque stop through Mobile Banking app

For Saving Accounts: Rs 50 + GST

For Other Accounts: Rs 100 + GST

Support Services

For any information/enquiries/disputes, please contact Help desk at 1800-889-0457(Toll-Free) or 7051510170, 7051510173 or mail at [email protected].

User Manual V1

Mobile Banking Registration Form V1

Ecommerce Enablement

Terms and conditions for Mobile Banking Application